How to Set Up a Stock Scanner for Swing Trading

Stocks screener tools and stock scanners play a crucial role in swing trading by identifying stocks with potential short-term price movements. While a stocks screener helps filter stocks based on specific parameters, a stock scanner provides real-time alerts to track momentum shifts. Additionally, using a calculator for CAGR (Compound Annual Growth Rate) can help traders measure long-term stock growth while focusing on short-term trading opportunities.

In this guide, we’ll walk through the steps to set up a stock scanner for swing trading and maximize trading opportunities.

Step 1: Choose the Right Stock Scanner

Before setting up your stock scanner, selecting the right platform is essential. Some of the best scanners for swing trading include:

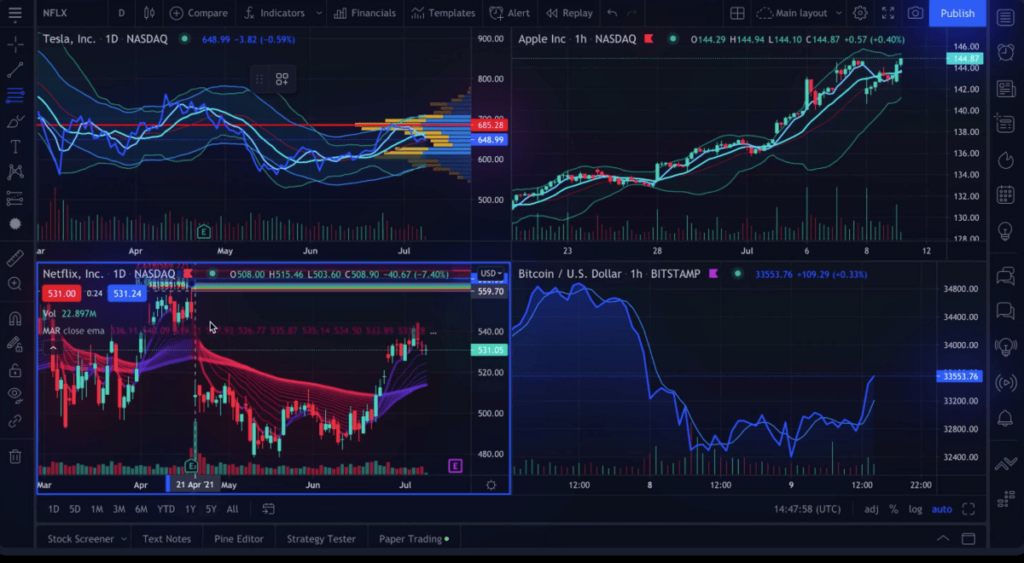

- TradingView – Offers custom scans and technical indicators.

- Finviz Elite – Provides real-time scanning and fundamental filters.

- Trade Ideas – Uses AI-based scanning for momentum trading.

- Benzinga Pro – Great for news-based swing trading alerts.

Step 2: Define Your Swing Trading Strategy

Your scanner setup should align with your swing trading strategy. Some common approaches include:

✔ Momentum Trading – Finding stocks with strong price movement.

✔ Breakout Trading – Identifying stocks breaking key resistance levels.

✔ Pullback Trading – Scanning for stocks retracing to support zones.

Step 3: Set Up Technical Indicators for Screening

A good stock scanner should filter stocks based on technical indicators that align with swing trading. Common filters include:

- Relative Strength Index (RSI) – Look for RSI between 30-50 for dip buys or above 70 for overbought conditions.

- Moving Averages (MA) – Scan for stocks crossing above the 50-day or 200-day moving average.

- Volume Surge – Stocks with volume increasing by 2x-3x the average.

- MACD Crossover – Stocks where the MACD line crosses above the signal line.

Step 4: Apply Fundamental Filters (Optional)

While swing trading focuses on price movements, combining fundamental filters can help refine stock selection:

✔ Market Cap – Mid-cap and large-cap stocks tend to have strong liquidity.

✔ Earnings Growth – Companies with consistent earnings growth attract momentum traders.

✔ Volatility – Stocks with an ATR (Average True Range) above 2% move enough for profitable swings.

Step 5: Set Up Real-Time Alerts

Once you’ve applied your filters, enable real-time alerts to receive notifications when stocks meet your criteria. Stock scanners like TradingView and Trade Ideas offer customizable alerts via email, SMS, or push notifications.

Step 6: Backtest and Adjust Your Scanner

Before using the scanner for live trading:

- Backtest historical performance to see if the criteria work.

- Refine filters if too few or too many stocks appear.

- Adjust settings based on market conditions (e.g., increasing volume thresholds during high volatility).

Final Thoughts

Setting up a stock scanner for swing trading helps traders spot high-potential stocks and take advantage of short-term price movements. Whether you use a stocks screener for initial filtering or a real-time stock scanner, combining technical indicators and volume analysis is key to success.

Additionally, for long-term investors, using a calculator for CAGR can help assess long-term growth potential while executing short-term swing trades. By leveraging the right tools, swing traders can improve trade execution and maximize profit opportunities.